Bitcoin Halving, What Is It? What Will Come After This Event?

Bitcoin Halving, an event that occurs approximately every 4 years, is always seen as a reliable indicator for a new price cycle in the crypto world. Let’s explore with CoinNerd the most important event in 2024 for the first and largest market-cap blockchain, along with the consequences this event may lead to for the BTC network from operational aspects to ETF funds.

What Is Bitcoin Halving?

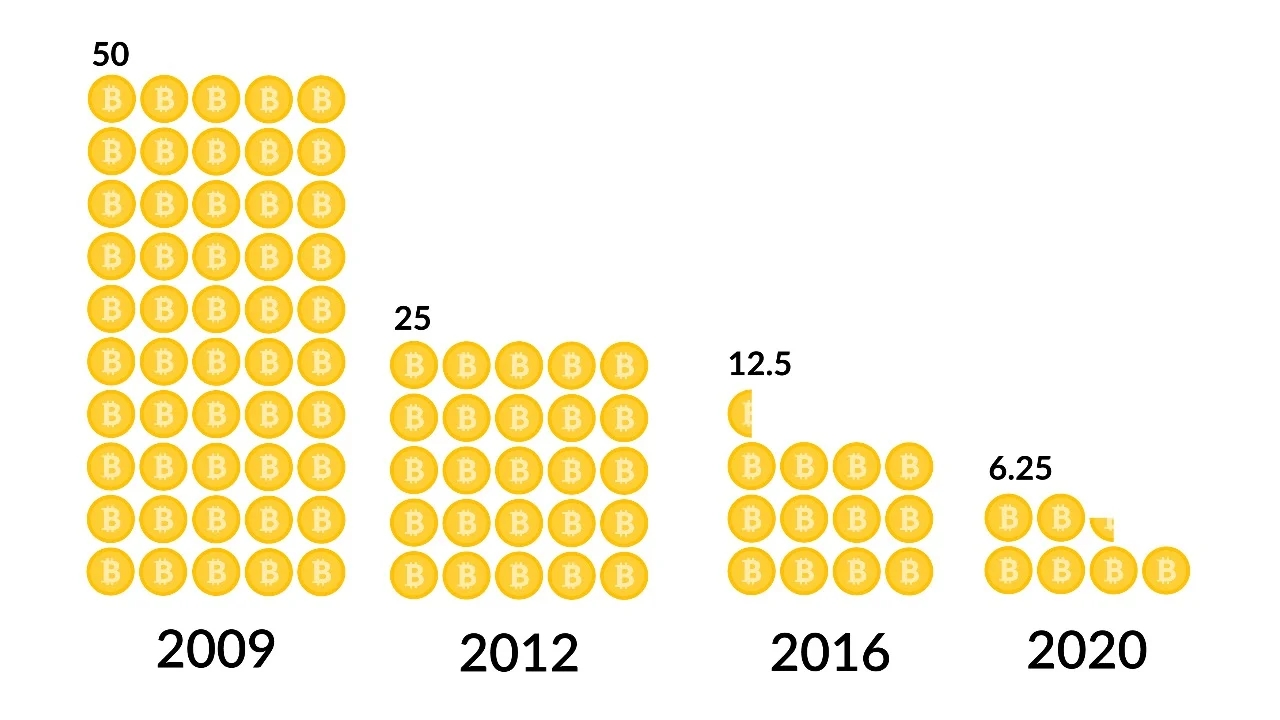

Bitcoin Halving is a significant event on the Bitcoin network, impacting the economic model of the chain significantly. When the protocol activates, the reward for each block will be halved, reducing the amount of new Bitcoin created and issued into the network. This transformation occurs after every 210,000 blocks mined, approximately every four years. It is a component of the Bitcoin protocol designed by Satoshi Nakamoto to control inflation, as the total number of Bitcoins that can be mined is limited to 21 million (BTC).

Bitcoin operates on a Proof of Work blockchain system. Miners race to solve a puzzle to find a random number that meets the system’s requirements, with the fastest miner finding the answer gaining the right to close the block and receive the reward (in this case, BTC).

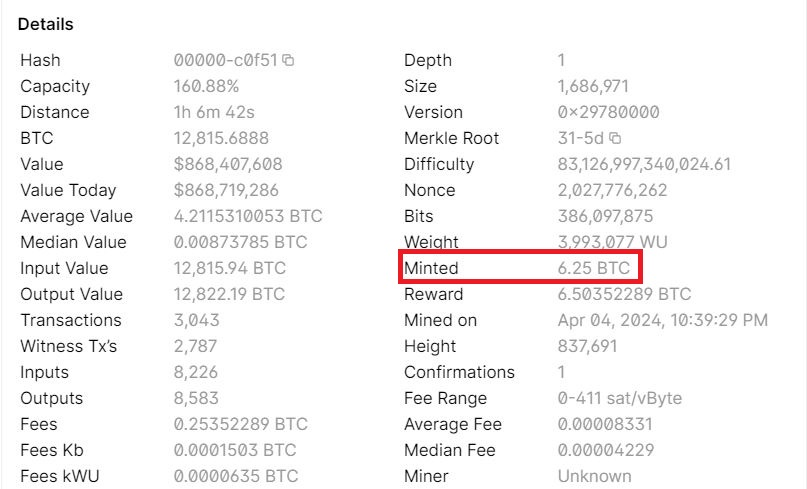

In the three previous “halving” events, which occurred in 2012, 2016, and 2020, the rewards for miners decreased from 50 (initially) to 25 BTC/block in 2012, then to 12.5 BTC/block in 2016, and since May 11, 2020, the reward has been 6.25 BTC per block up to the present time. Bitcoin is approaching its 4th Halving, where the miner’s reward will decrease to 3.125 Bitcoin, expected to take place in the latter half of April 2024 (scheduled for April 20, 2024). This cycle will continue until a total of 21 million Bitcoins on the network are mined, expected to happen in 2140.

Now, let’s look back a bit at history to see how the market reacted to previous halving events.

Market Fluctuations History After Bitcoin Halving

Conventionally, when a product’s supply decreases and market demand increases, it tends to lead to an increase in the price of that product. However, in the crypto market, this is not always the case, with Bitcoin being a prime example.

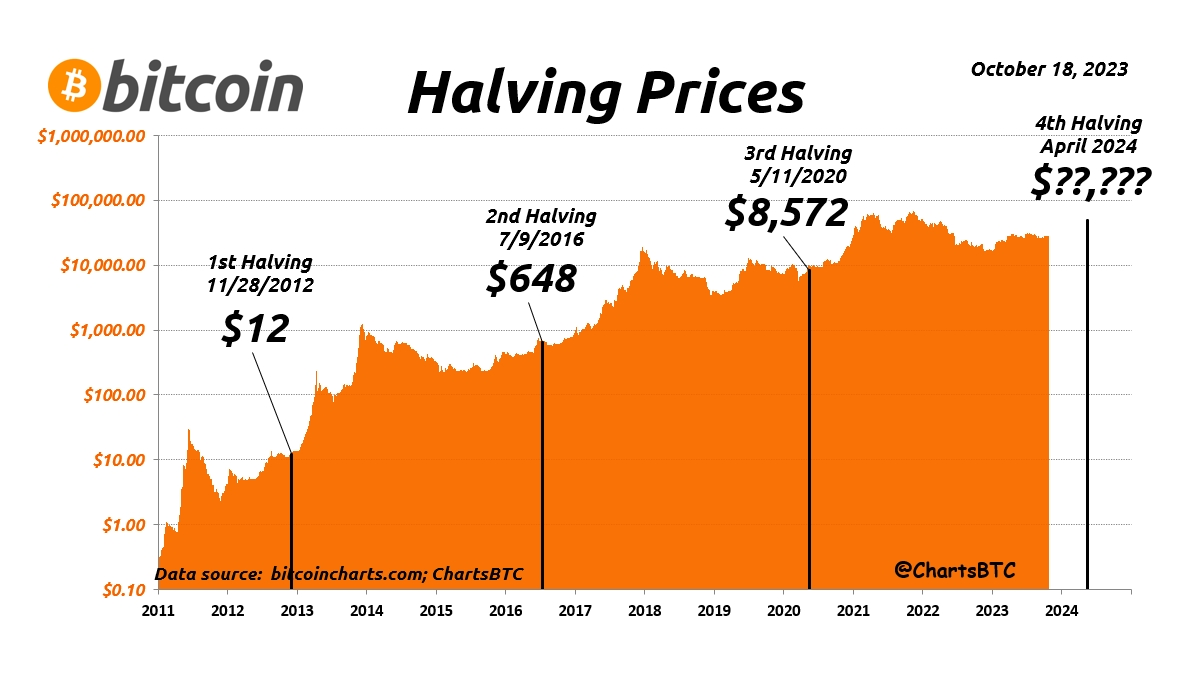

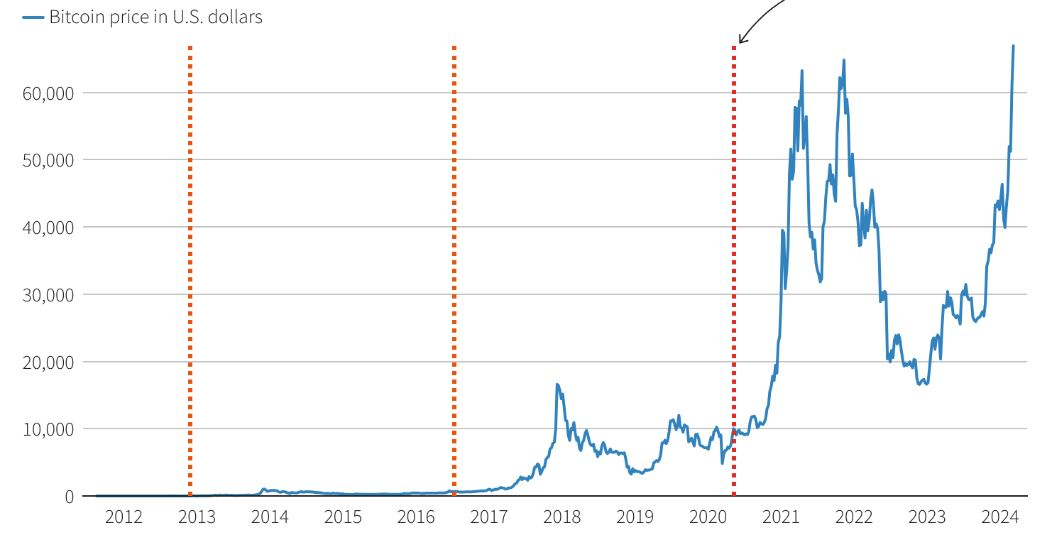

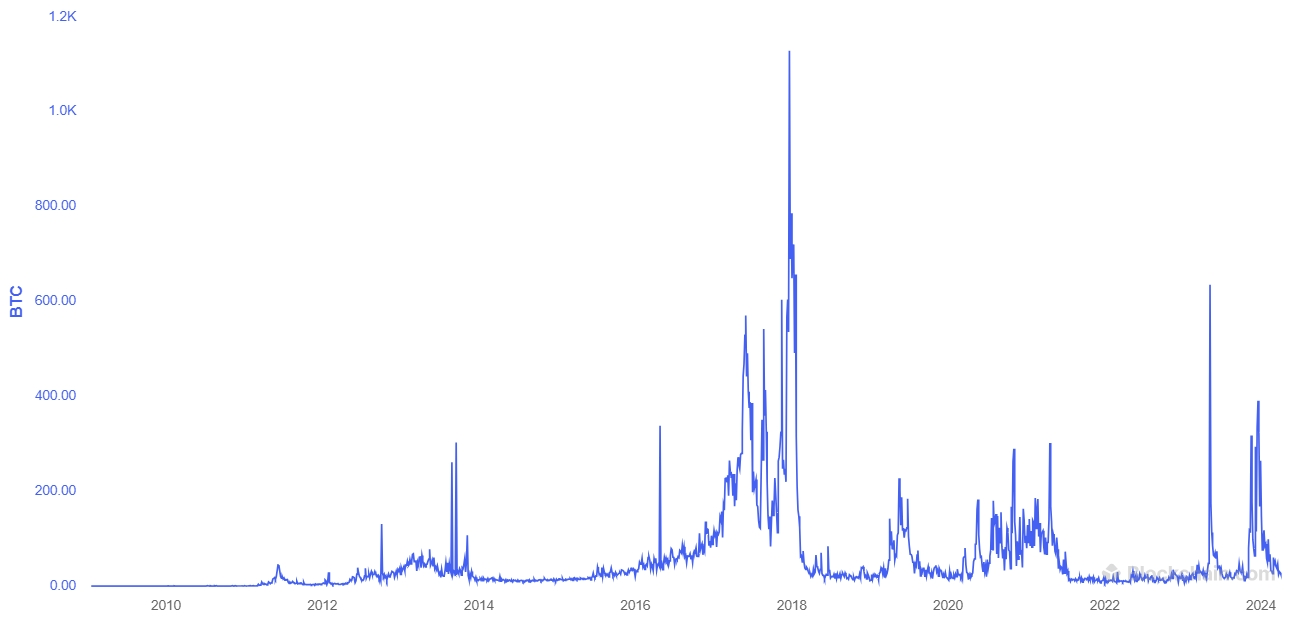

Specifically, the price of Bitcoin before the 2012 halving was around $12, then rose to approximately $1,000 a year later. In the second halving event on July 9, 2016, Bitcoin was around $650, then dropped to below $500 in less than a month, before rising to around $2,500 in July 2017, ultimately reaching nearly $20,000 by the end of that year in the first cryptocurrency market boom.

In the most recent halving in May 2020, Bitcoin experienced a slight decline before reaching a peak of $69,000 in the second crypto market boom in September 2021.

Bitcoin Halving, what is it? Price history at Halving events.

Price History At Halving Events

In general, Halving events are not reliable indicators for price increases, as BTC still experiences high volatility after each event. Moreover, Bitcoin’s history only includes three Halving events, which is not a large enough sample size to confirm anything. However, comparing long-term data, BTC prices typically peak about a year after Halving events, and the community believes that each Halving event marks the beginning of an uptrend phase, coupled with demand from ETF funds, will drive BTC to new highs. But is reality as optimistic? Let’s take a look at the underlying icebergs within the Bitcoin network awaiting recovery after this event.

Is The 4th Bitcoin Halving A Positive Indicator?

History Has Not Repeated Itself

In the three previous Halvings, Bitcoin reached an All-Time High (ATH) about a year later. However, in this upcoming Halving, BTC has already set a new ATH with a price of over $73,000 after Bitcoin ETF proposals were approved by the U.S. Securities and Exchange Commission (SEC). Additionally, the market has gradually warmed up after legal news: FTX exchange lawsuit, Binance exchange dispute in the U.S., SEC’s disputes with Coinbase, and Ripple being gradually resolved.

Now, the market can hardly rely on past information to believe that the fourth Halving will bring about a price increase when BTC has already broken its ATH before the Halving event. Furthermore, the volatility in trading volume from Bitcoin ETFs makes trend prediction much more difficult.

Impact On The Operational Network

Each Halving event will slow down the inflation rate on the network but also means that the rewards from block closure for miners decrease. Here, the community can clearly see the conflicting interests between:

- On one side are BTC holders/traders: reducing inflation decreases the amount of new BTC generated, likely causing the BTC price to rise.

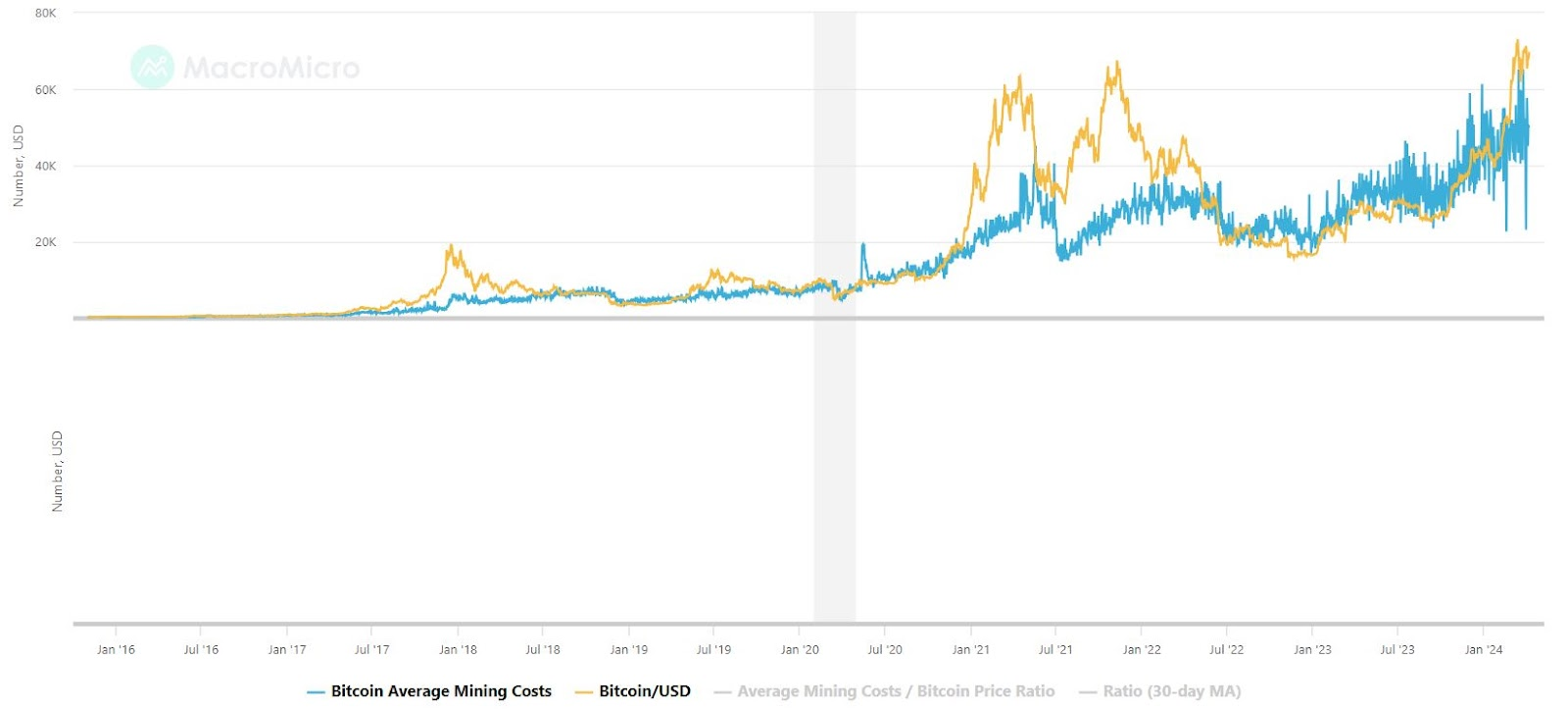

- On the other side are operators: receiving fewer BTC rewards (from 6.25 BTC to 3.125 BTC), which means reduced profits from mining. This leads to a deficit in cost/revenue balance. Another point to note is that the revenue from winning the block closure right is the primary revenue (accounting for 75-95%) of mining facilities, as transaction fees collected from the network are very limited.

However, a blockchain network always needs an operational system to maintain transaction verification, even when new BTC cannot be mined. When block closure revenue is halved, and transaction fee revenue does not increase enough to compensate (at 0.25 – 1.2 BTC/block), and blocks are limited (1 MB/block), mining facilities will consider stopping operations. At this point, the hardware race to solve puzzles becomes more intense, with underpowered mining facilities being left behind, leading to network centralization and impacting Bitcoin’s security.

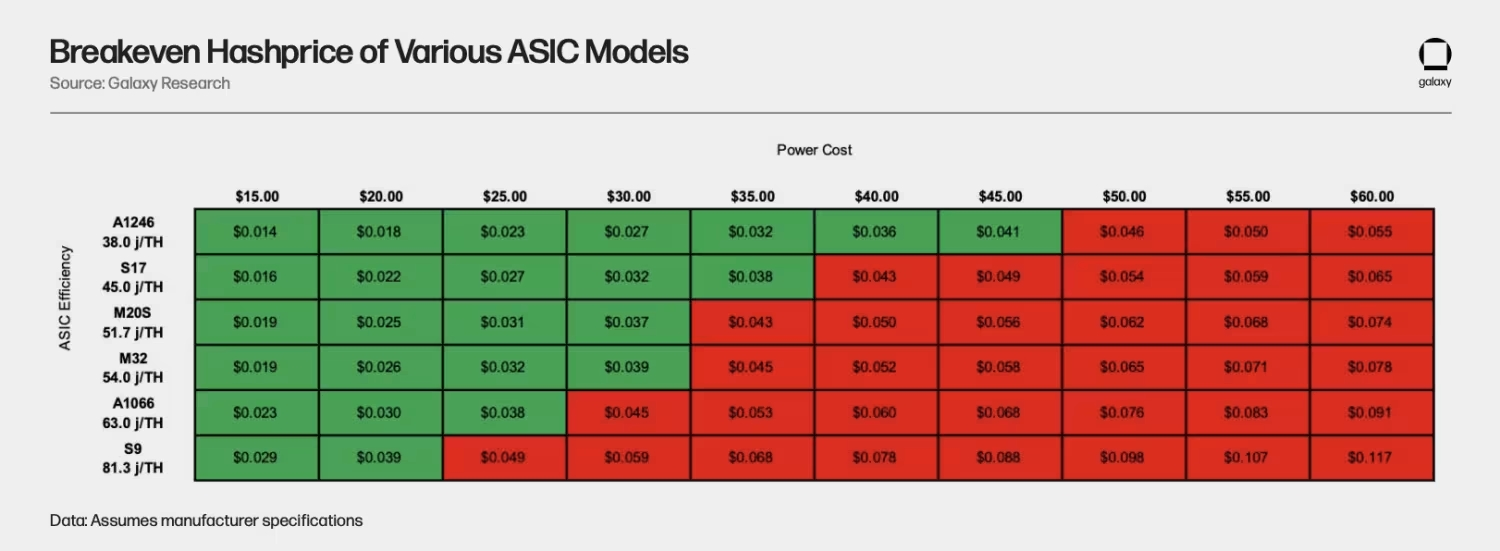

According to analysis data from Galaxy, about 15-20% of ASIC mining equipment (devices specialized for BTC mining) will go offline after the 2024 Halving due to insufficient computational capacity to compete. These devices include Bitmain’s S9, Canaan’s A1066, and MicroBT’s M32.

Impact From ETF Funds

Bitcoin ETF products have been approved by the SEC since January 11, 2024, marking a huge turning point between the traditional financial world and the cryptocurrency market. From then on, investors can access the largest cryptocurrency market cap without directly holding it. Typically, steps like setting up wallets, creating accounts on exchanges, trading, storing, and security risks are significant barriers for new users to access crypto.

The flow of funds from ETFs is considered one of the main reasons for BTC’s price reaching new highs. However, the participation of ETF providers and the traditional financial world in Bitcoin’s economy alongside the benefits also bring many risks.

Initially, Bitcoin was created to address society’s trust issues when financial products issued by centralized institutions collapsed. The Bitcoin network was developed to demonstrate that users can trade assets without going through any intermediary organizations. Now, the community seems very excited about the prospect of price increases but forgets that as ETF funds hold more BTC, the amount of BTC traded on the Bitcoin blockchain will gradually decrease. Gradually, the game becomes.

just speculation rather than using BTC for transaction purposes. Moreover, the decentralized nature of the network will also be directly affected as BTC will not be distributed among users but concentrated in ETF-providing institutions.

Another risk point from Bitcoin ETF institutions, which is not often highlighted or noticed by people, is that these funds have full decision-making authority over assets in the fund when a hard fork occurs with the Bitcoin blockchain. This is not an unlikely scenario because every time the Bitcoin community has conflicts, the chain will fork and form a new chain. The community can name cases like Bitcoin Cash, Bitcoin Diamond, Litecoin, etc. Now, if participating in Bitcoin trading through ETFs, users also do not have the right to choose which chain to follow, and the decision-making power will lie with fund institutions. Bitcoin was born in 2009, offering the opportunity for individuals to truly hold their assets, but it seems people have forgotten the pain of the past and are ready to give power to centralized institutions once again.

Conclusion

Bitcoin Halving is an event that slows down the inflation rate on the Bitcoin network, but this is a mechanical impact, mainly affecting the price of BTC in the market.

The issues of conflicting interests between BTC holders/traders and mining system operators remain intact. Alongside that are the impacts from traditional centralized financial institutions through ETF funds. Clearly, the Bitcoin community needs to sit down and find optimal solutions for these issues, as well as the scalability problem of the chain.

Through this article, CoinNerd hopes to provide readers with multidimensional perspectives, along with potential risks that may arise on the Bitcoin network after the Halving event. Blockchain was created to solve humanity’s trust issues, and we just need to trust the protocol, cryptography, without relying on any intermediary organizations. Let technology truly be a tool to help society behave more ethically rather than chasing events to create FOMO, short-term price impacts.

READ MORE NEWS ON

Bitcoin | Inflation Deflation Deflation Inflation Cryptocurrencies

* We hope this information will help you in your investment process, but this is not investment advice. Every investment carries risk, especially in this industry, so DYOR before making a decision.