Blackrock’s Bitcoin ETF Smashes Records With 70 Consecutive Days Of Growth, Securing Coveted Membership In Elite Club

- BlackRock’s spot bitcoin ETF saw net inflows for the 70th consecutive day, placing it among the top 10 exchange-traded funds with the longest streaks of daily inflows.

- On Monday alone, the fund attracted more than $600 million in net inflows.

BlackRock’s spot bitcoin ETF maintained its momentum on Monday, registering net inflows for the 70th consecutive day. This achievement placed BlackRock’s ETF among the top 10 exchange-traded funds with the longest streaks of daily inflows.

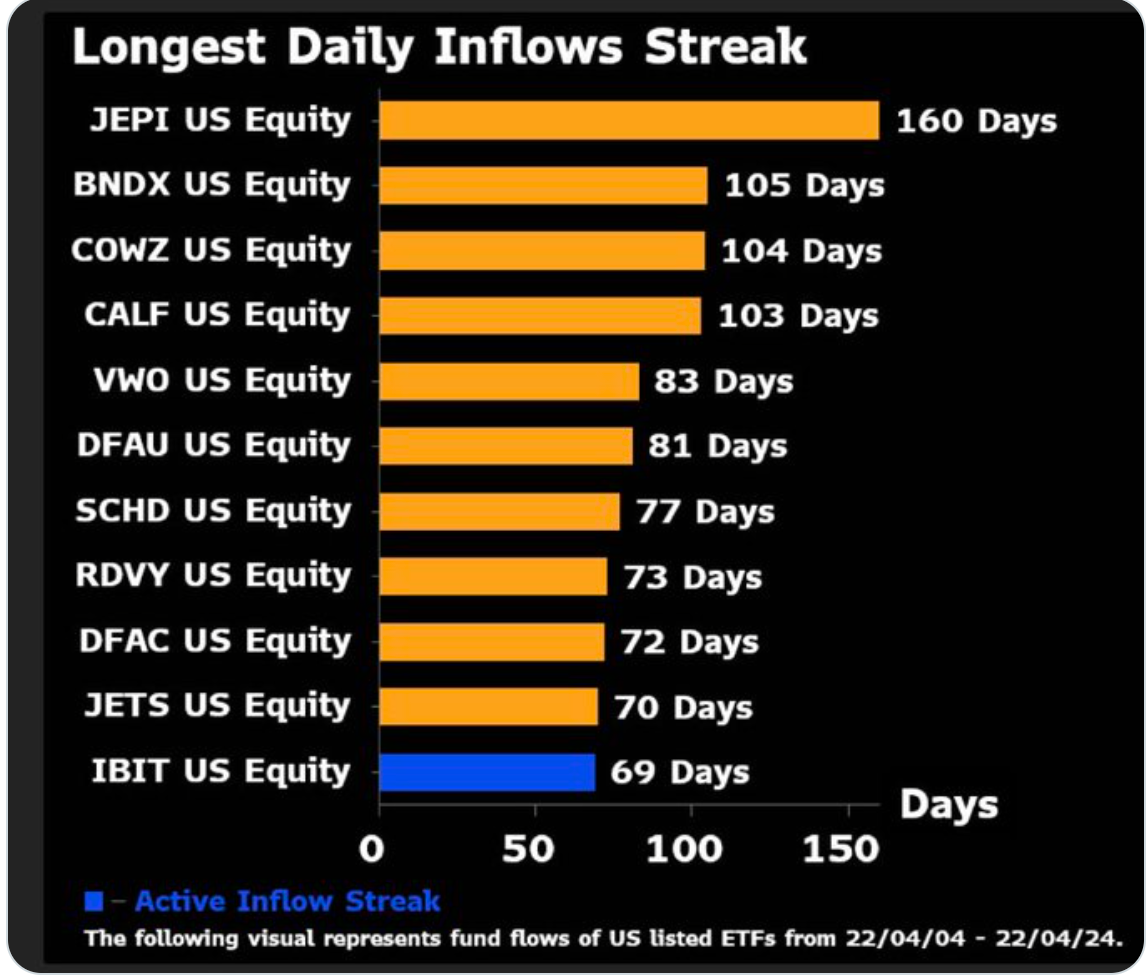

Earlier on Monday, Bloomberg’s senior ETF analyst Eric Balchunas shared a graphic on X indicating that if BlackRock’s ETF, ticker symbol IBIT, achieved its 70th day of net inflows, it would join the ranks of some of the most successful exchange-traded funds in history.

“IBIT inflow streak currently at 69 days. One more day and it moves into top 10 and ties JETS,” Balchunas posted. The JETS exchange-traded fund, which combines shares in companies operating in the airline industry, has also achieved 70 straight days of inflows, according to data posted by Balchunas. Before Monday, JETS sat alone at number 10.

The JPMorgan Equity Premium Income ETF (JEPI) holds the record for the longest streak of daily inflows, with 160 consecutive days, as noted in the Bloomberg analyst’s post.

Blackrock Sees Over $600 Million In Inflows

BlackRock’s spot bitcoin ETF recorded $600 million in net inflows on Monday, pushing its total assets under management (AUM) to 18.2 billion, according to the financial firm.

Grayscale’s spot bitcoin ETF (ticker GBTC) has remained the largest among crypto-based funds since their debut in January, but consistent outflows suggest it might soon lose this title to BlackRock’s competing product.

Grayscale’s fund, originally launched with nearly $30 billion in assets under management (AUM) after converting its flagship fund, charges a higher fee compared to BlackRock’s ETF.

READ MORE NEWS ON

Bitcoin | Inflation Deflation Deflation Inflation Cryptocurrencies

* We hope this information will help you in your investment process, but this is not investment advice. Every investment carries risk, especially in this industry, so DYOR before making a decision.