Are Restaking & EigenLayer Associated with Any Potential Risks?

Restaking is not a new concept, but it has maintained a strong interest from the community, in part due to the pioneering project in this area, EigenLayer. However, is this solution really a new breakthrough, or is it simply a new “leverage of leverage” game in DeFi? Let’s explore it in the article below, guys!

Restaking – New But Old

So why does this keyword attract market attention? It’s because of EigenLayer with rumors about ‘Retroactive.’ As users discuss airdrops, they tend to explore the concept behind the product, leading to the keyword ‘Restaking’ being ‘repeatedly’ referenced.

Does ReStaking Have Risks?

Of course, there are, so in this article, I’d like to list some information about these risks for your reference. However, I don’t deny the benefits this solution might offer, as these details have been covered in various other articles.

This piece will focus solely on analyzing the potential risks arising from this model, particularly EigenLayer’s product.

It is important to emphasize that you can rely on this information, combined with your personal risk appetite, to make the most appropriate decision for yourself. I also welcome feedback and opposing views on this story, so you can discuss it further in the Fomo Sapiens community!

Smart Contract

If you’ve ever experimented with Restaking on EigenLayer’s product, you’ll notice they have a separate contract address. This is where you send your LST, and it’s considered ‘delegation’ to the protocol.

Who manages this contract?

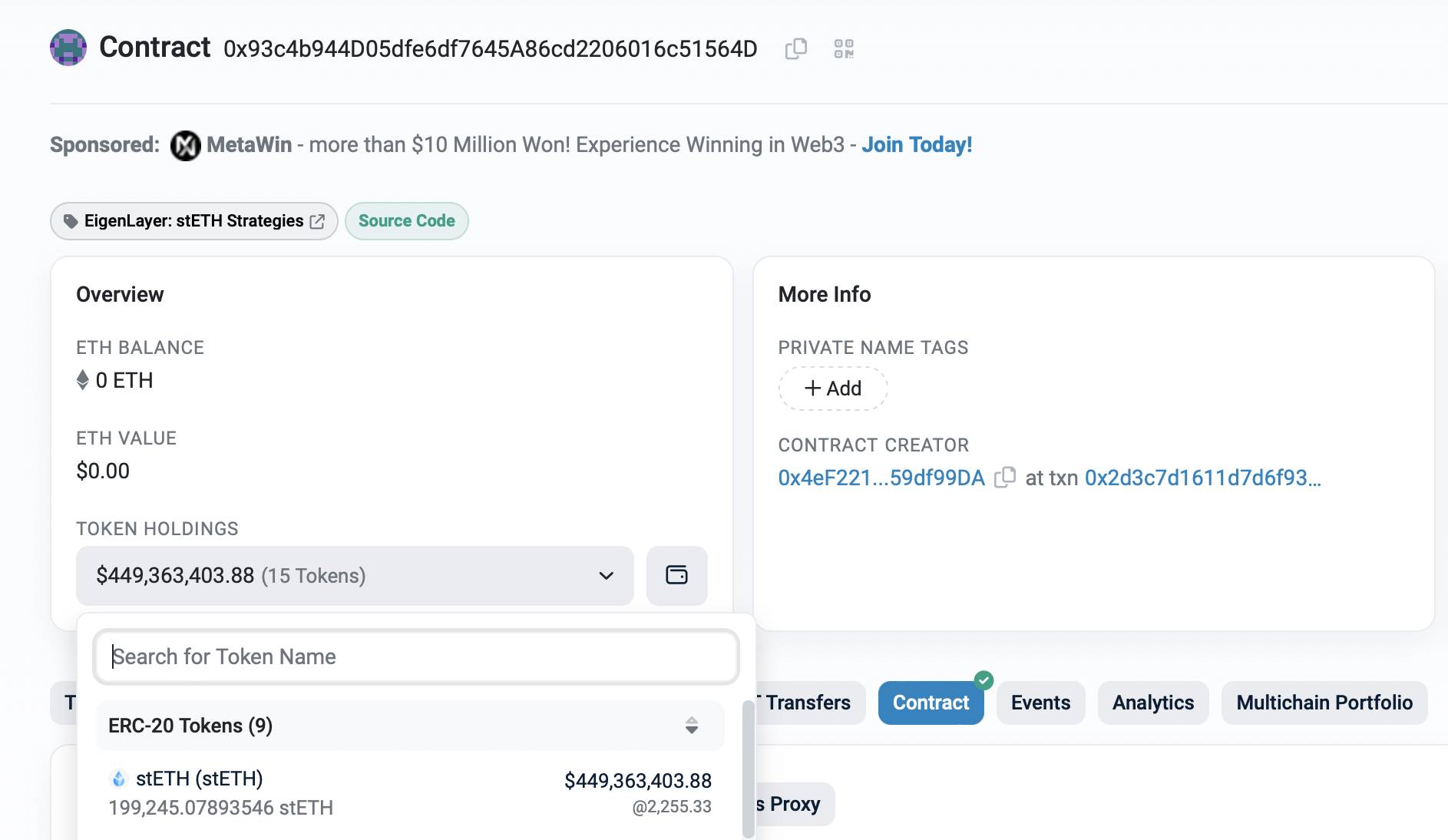

Let’s first take an example from the stETH pool, one of the largest TVL attracting pools after a few rounds of delegation from EigenLayer, folks!

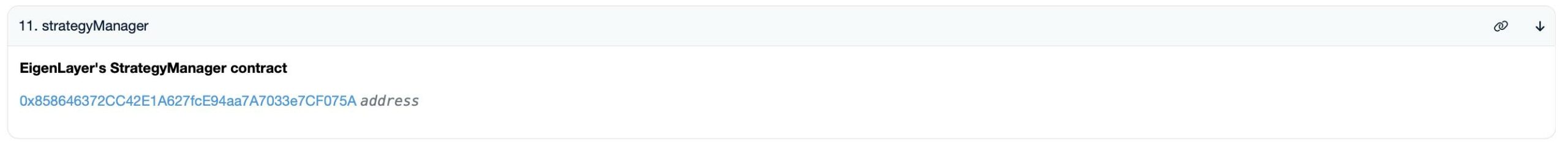

The contract ‘0x93…564’ currently holds about 200,000 stETH tokens (approximately 450 million USD). If we scroll down to the Strategy Manager section, which is the contract managing the strategies for this pool, we’ll access the address ‘0x858…75A’.

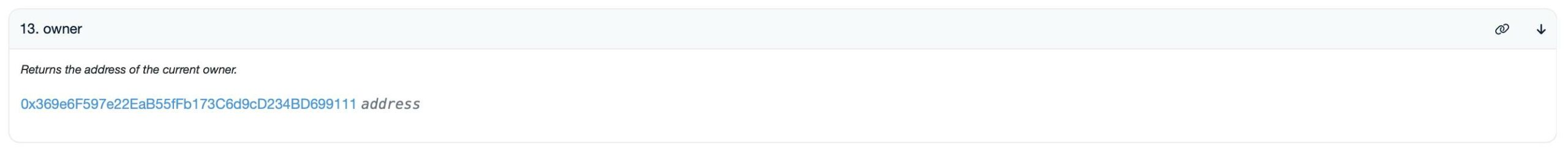

Continuing to the “Owner” section of “0x858…75A,” we’ll reach the wallet “0x369…911”. This is a Multisig wallet created through the Safe Factory Contract.

In simpler terms, there will still be a group of signatures managing the contract to which we’ve delegated our stETH. The use of a Multisig wallet isn’t uncommon in projects. However, what’s noteworthy is Eigenlayer’s management mechanism, the “Proxy Contract” – a system of smart contracts that can be altered in the future.

I won’t draw any conclusions about the project’s use of the Proxy Contract, as this mechanism enables them to execute functions like delegating authority to other contracts, which is specific to Restaking. Additionally, the Proxy assists in upgrading and handling bugs if they occur.

However, it will create some concerns about the project’s sustainability in the future, and this is something you need to consider when delegating to Restaking projects.

Bribe Model For AVSs

Restaking is considered a solution to help increase capital efficiency for retail investors more than for large organizations. This is because large organizations tend to be reluctant to “be affected by their reputation” if they are involved in airdrops or bribes of strange, meme, or even fraudulent tokens.

Clearly, the source of APR from tokens that suddenly increase by thousands of percent is something that attracts and creates new momentum for AVS (Actively Validated Services) and directly for Stakers. However, there are legal risks and EigenLayer will need to consider the management model, how to balance the factors of decentralization, legality, and returns for retail users.

Second Lido?

This story unfolds not only in the Restaking sphere but also within the Distributed Validator Technology. I’ve also addressed the risks of a new, more dominant class of governance, which adds further risk to the Ethereum network in the article below. Those interested can delve deeper into it!

It’s apparent this is a challenge that will arise with any market segment built on Liquid Staking. Sooner or later, EigenLayer will introduce network governance tokens, enabling a certain individual or group to potentially influence project activities and assets locked within the platform. This is a narrative that even Lido is grappling with at the moment.

Beyond governance concerns, the slashing risk with ReStaking will persist, a factor that occasionally surfaces in Lido’s product.

The MEV problem won’t be entirely resolved by Restaking. In fact, EigenLayer has incorporated existing Layer-1 PBS models (such as Mev-Boost) into its Restaking layer to address the MEV issue.

Vitalik himself has mentioned the complexity of Ethereum’s consensus layer in a blog post.

And it can be seen that the founder of Ethereum does not want to create an additional “DAO” layer that overwrites the original layer without further solving the core problem.

Future Changes In Ethereum

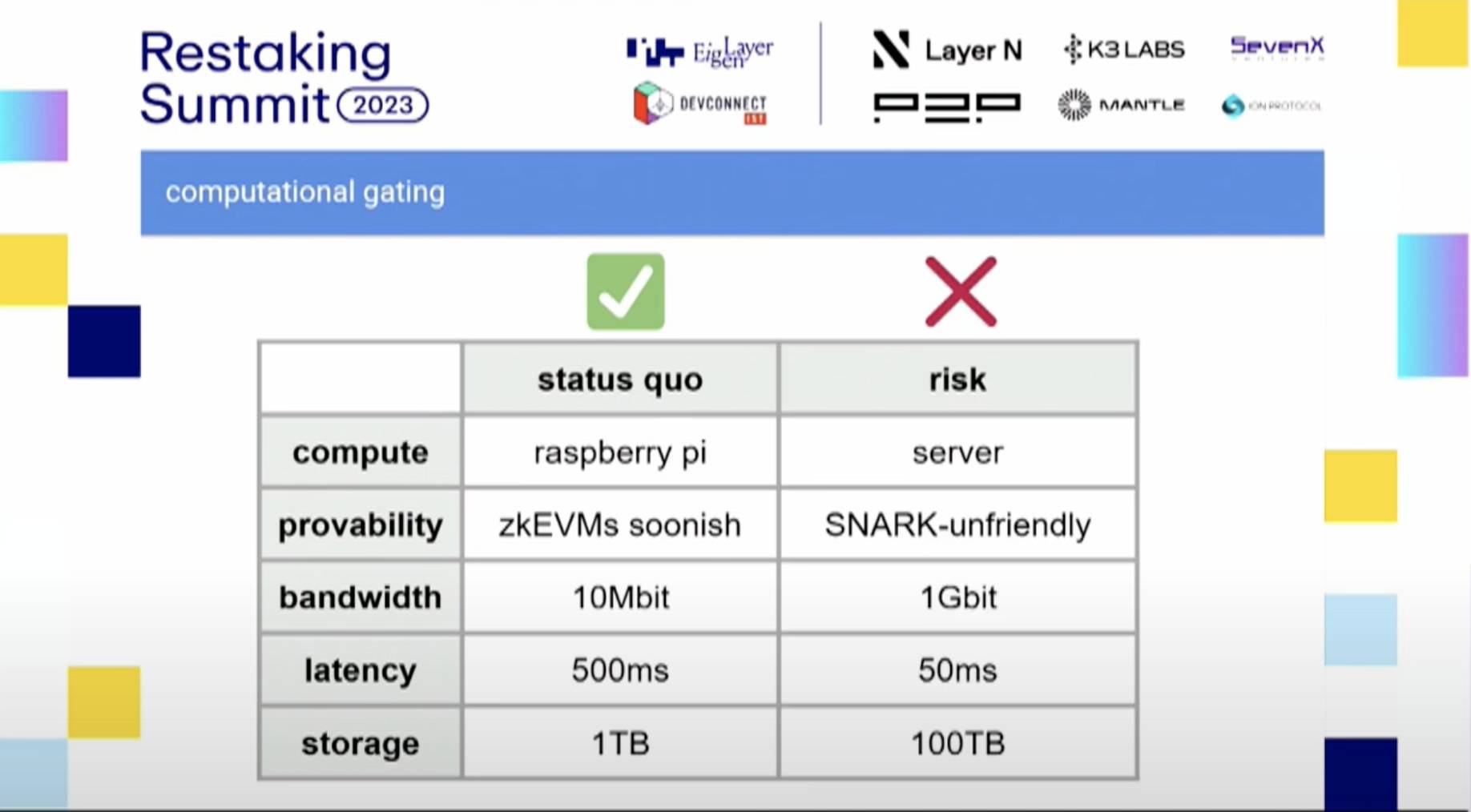

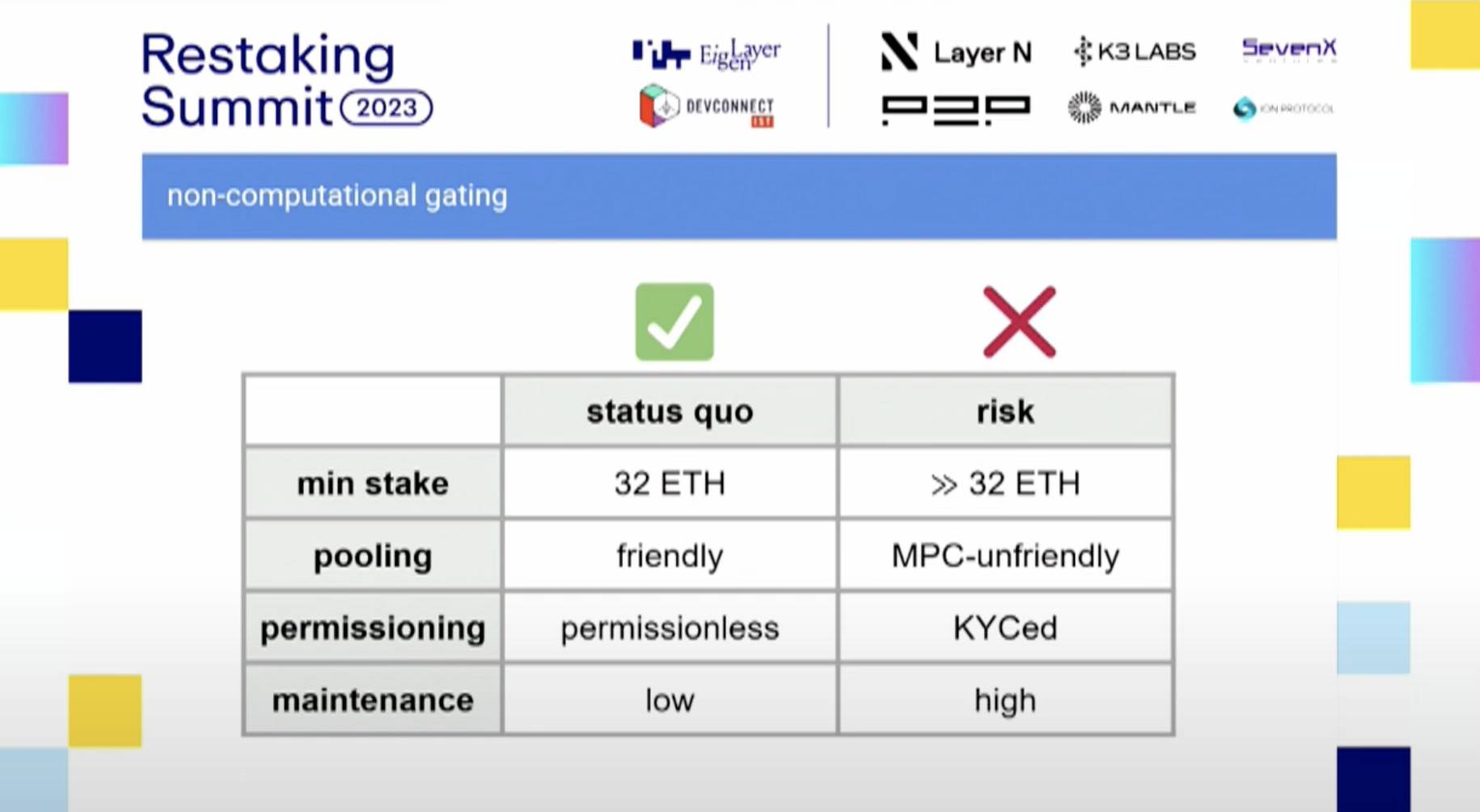

At the Restaking Summit conference in late 2023, developer Justin Drake also outlined several risks that could arise with EigenLayer if Ethereum undergoes changes in the future.

The first risk concerns computation (pressure on Validators). Presently, the cost to operate a Validator for Ethereum is significantly lower compared to the general landscape of other blockchains. However, with several proposed changes in the future, hardware and computation barriers will make Restaking operations challenging. This is because Multi-Party Computation (MPC) tasks will become more complex, and in the context of a “derivative” network, the interaction messages among AVS in EigenLayer will be significantly affected due to these barriers.

The second risk mentioned concerns the financial cost required to participate in validation. Currently, there’s no specific plan indicating how much ETH a Validator will need to participate in network validation. However, an implicit understanding suggests that it will be higher than the current 32 ETH.

The story about raising the minimum ETH stake for a Validator is becoming clearer, especially after the latest post regarding the “Post-Single Slot Finality model” proposal from Vitalik Buterin.

And if you’re curious about what Single Slot Finality is, you can also read more about it at this link.

Conclusion

So that’s a brief overview of some potential risks associated with the Restaking model. I know this remains a hotly debated topic within the Twitter community. As mentioned earlier, I’m eager to hear different perspectives from you all on this matter.

Hopefully, this content has been helpful and looking forward to catching up with you in another article soon!

READ MORE NEWS ON

Bitcoin | Inflation Deflation Deflation Inflation Cryptocurrencies

* We hope this information will help you in your investment process, but this is not investment advice. Every investment carries risk, especially in this industry, so DYOR before making a decision.

ABOUT THE AUTHOR