El Salvador Breaks Ground With First Ever Bitcoin Bond!

The “Volcano Bond” was first announced in November 2021 by President Nayib Bukele. The Central American country is expected to issue $1 billion in BTC bonds in conjunction with its ambition to build a “Bitcoin City” powered by renewable energy from the country’s volcanoes.

At the beginning of 2023, the Legislative Assembly of El Salvador passed a law on the issuance of digital assets, paving the way for the country’s Bitcoin bond plan.

However, El Salvador’s plan was once rated as high-risk by many financial experts because the country has a large public debt. In fact, it was “stalled” throughout 2022 due to legal barriers and the depressed market conditions at the time.

In addition, the opposition in the El Salvador government also believes that the legalization of crypto assets will facilitate criminal activities such as money laundering, tax evasion, and more debt accumulation.

BNB Chain Announces BNB Greenfield Development Roadmap

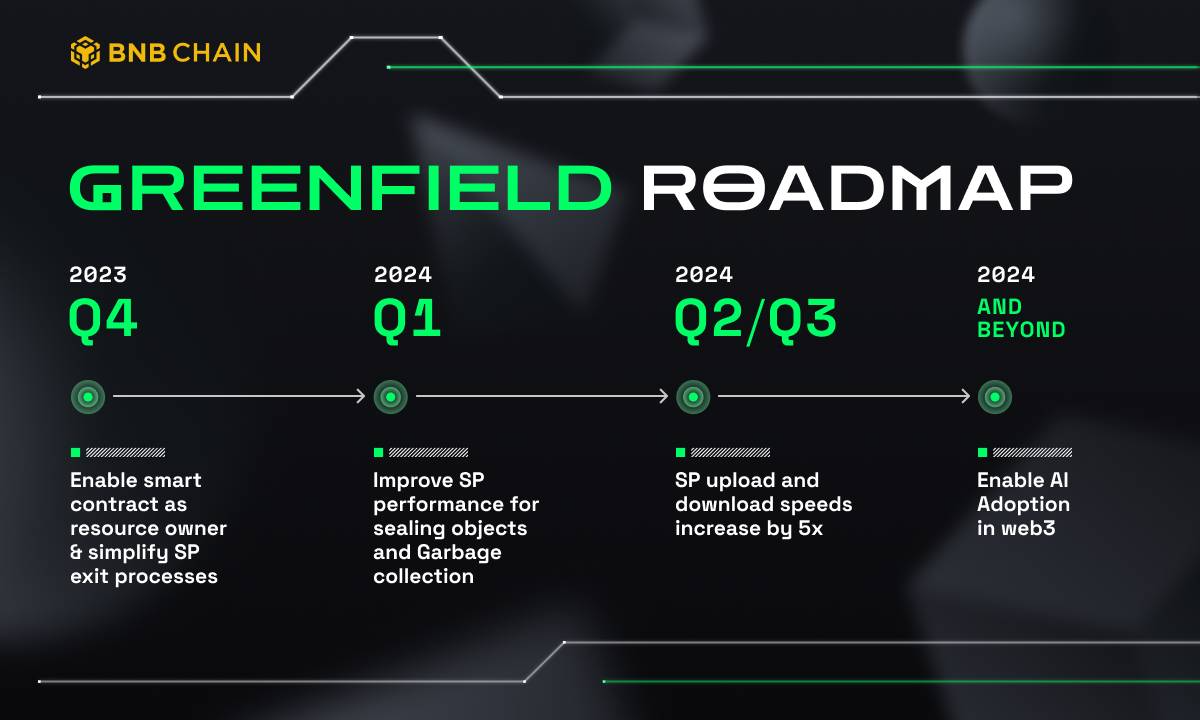

On the afternoon of December 12, 2023, BNB Greenfield, a decentralized data storage blockchain built on the infrastructure of BNB Chain, unveiled its development roadmap with numerous enhancements aimed at enhancing user experience and developer friendliness.

According to the announcement, the latest development roadmap of BNB Greenfield spanning Q4/2023 to the end of 2024 aims to enhance performance for all users, simplify development processes, target multichain capability, reduce gas fees on opBNB by 10x, enable AI integration in Web3, and ensure network stability through effective governance and maintenance.

Greenfield is a solution that supports users and dApps on the BNB Chain ecosystem to create, store, and trade data in a common economy.

Lido TVL Crosses The $20 Billion Mark

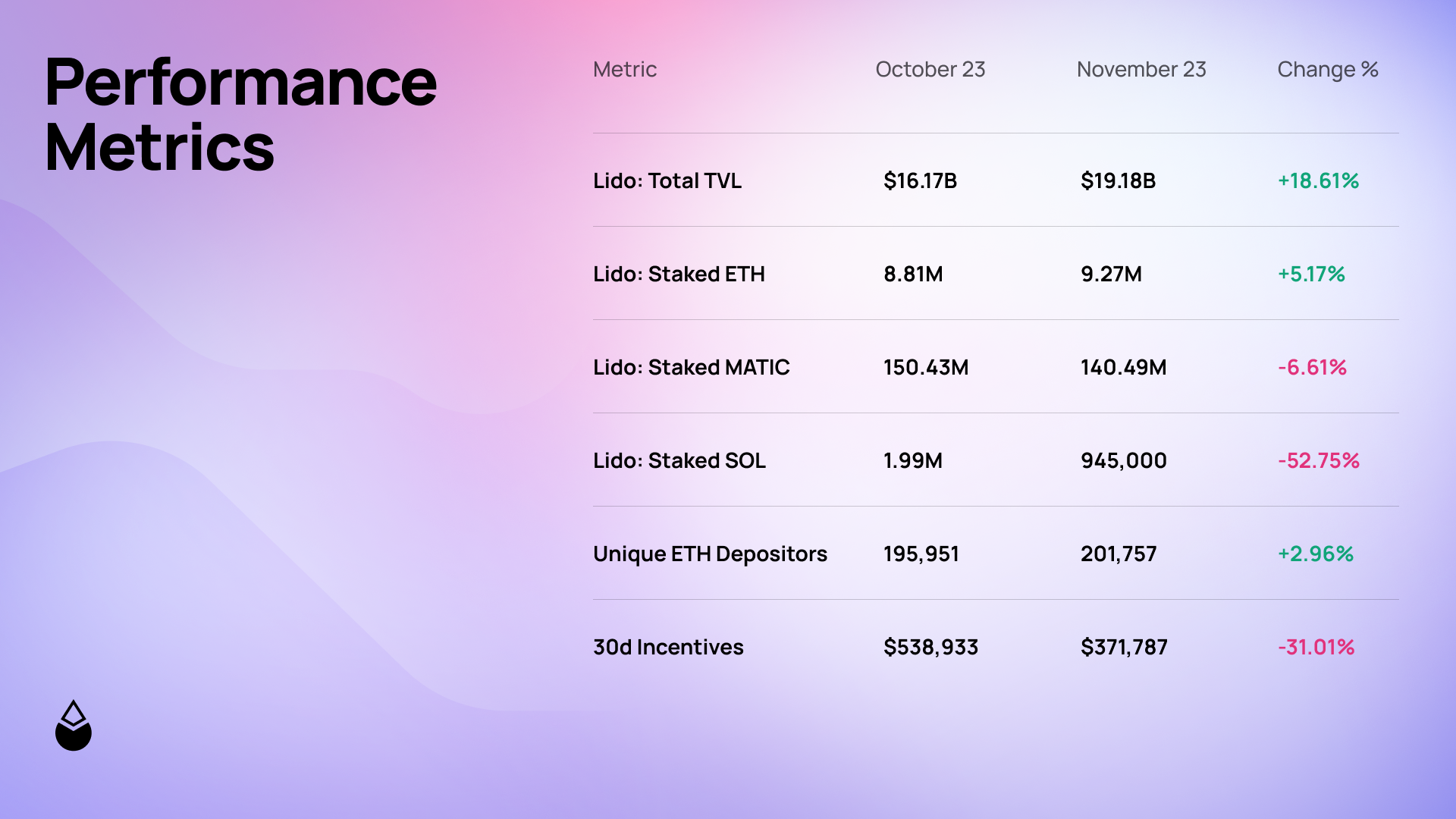

According to Lido Finance’s monthly report, the staking protocol announced that its TVL (total value locked) crossed the $20 billion mark for the first time since April 2022, up 18% from October.

However, the community is skeptical of the data, as it is self-reported by Lido and the number is too high. Despite benefiting from the recent market rally, as well as Ethereum ecosystem tokens all jumping in unison, the staking protocol did not actually have too many outstanding activities to attract the above large amount of capital flow in November.

The previous month, the protocol also saw a decline in Solana (SOL) staking assets, down more than 50%, possibly from FTX-related wallets starting to unstake SOL and transfer to CEX exchanges.

In the report, Lido also mentioned several new developments of the protocol, such as the unification of proposals in the DAO, with a typical example being the DVT testing proposal; or the listing of LDO on the Haskley exchange and the integration of wstETH into Aave V3 on Base.

Cryptocurrency Attacks In November Took $340 Million

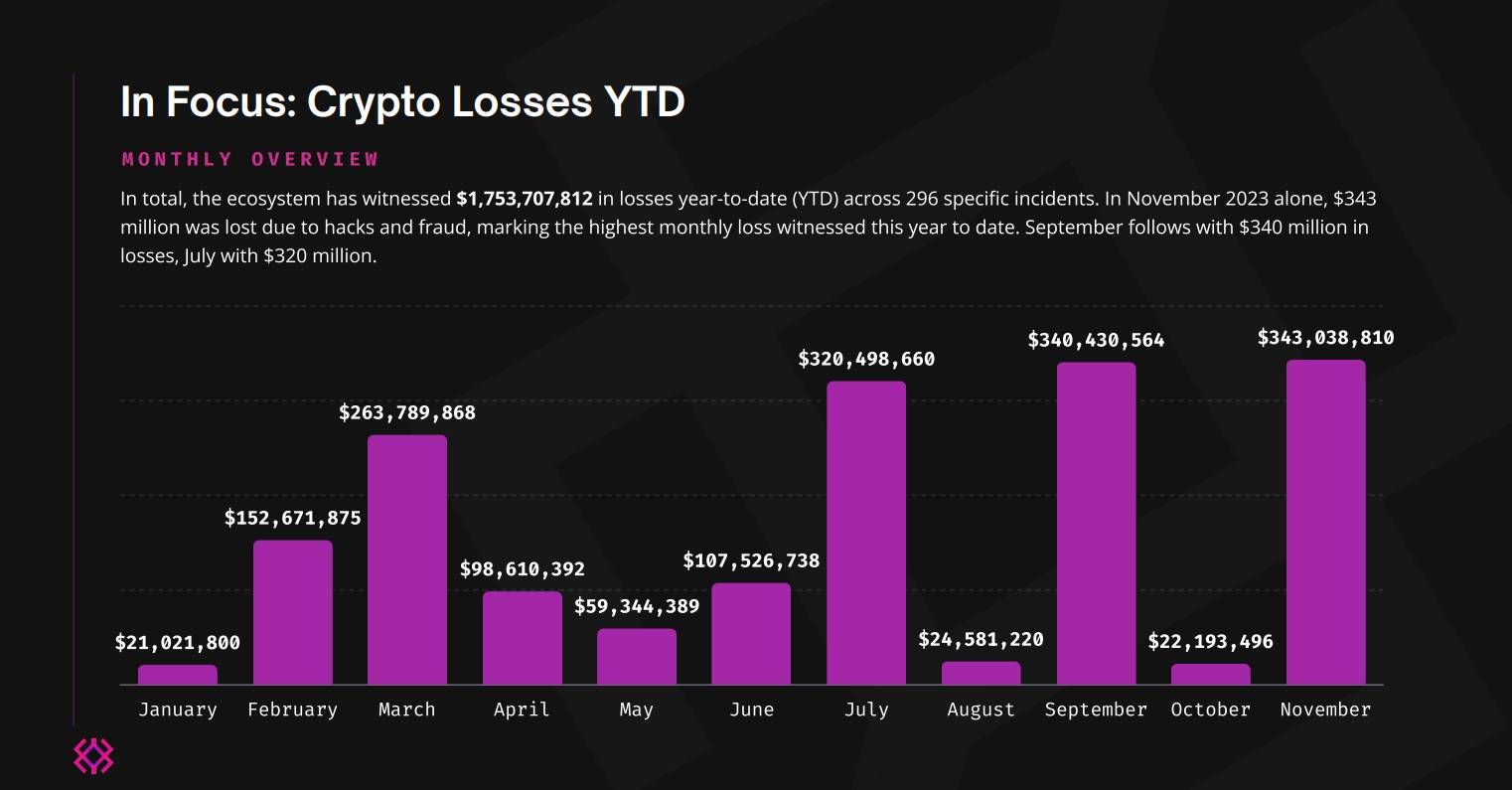

Since the beginning of the year, there have been a total of over 295 attacks and rug pulls, siphoning off more than $1.75 billion from the crypto market. Notably, the losses in the past month have skyrocketed 15 times compared to the $22 million figure of the previous month.

In the month, centralized finance (CeFi) platforms were the preferred targets of hackers, accounting for over 53% of the total losses (about $184 million) with only 4 attacks. Leading the list are Poloniex ($125 million), HTX ($86 million), and Kronos Research ($25 million).

On the same scale, the remaining 46.2% of losses fell into the DeFi segment, with 37 rug pulls totaling $158.6 million. Meanwhile, the DeFi attack rate accounted for as much as 72.9% in the third quarter.

Immunefi says it has paid out over $85 million in bounty rewards to date and has helped to protect $25 billion in user funds on protocols such as Chainlink, The Graph, Synthetix, and MakerDAO. In September 2023, Immunefi launched its on-chain vault, marking the beginning of its journey to decentralize its bug bounty platform.

READ MORE NEWS ON

Bitcoin | Inflation Deflation Deflation Inflation Cryptocurrencies

* We hope this information will help you in your investment process, but this is not investment advice. Every investment carries risk, especially in this industry, so DYOR before making a decision.