Crypto Community In Dash For ETH: Frenzy Ensues As Celsius Halts Staking

500,000 ETH worth around $1 billion are queued for validation by over 15,000 validators, awaiting withdrawal to wallets after lending company Celsius declared bankruptcy and ceased staking.

Translation 1:

According to data from ValidatorQueue, the Ethereum blockchain has seen a record increase in the number of validators in the exit queue over the past three months, reaching over 15,000. This means that there are currently around 500,000 ETH, worth over $1 billion, being held by validators waiting to be withdrawn to their wallets (1 validator is equivalent to 32 ETH).

In the past three months, the Ethereum blockchain has seen a record increase in the number of validators in the exit queue, reaching over 15,000. This means that there are currently around 500,000 ETH, worth over $1 billion, being held by validators waiting to be withdrawn to their wallets.

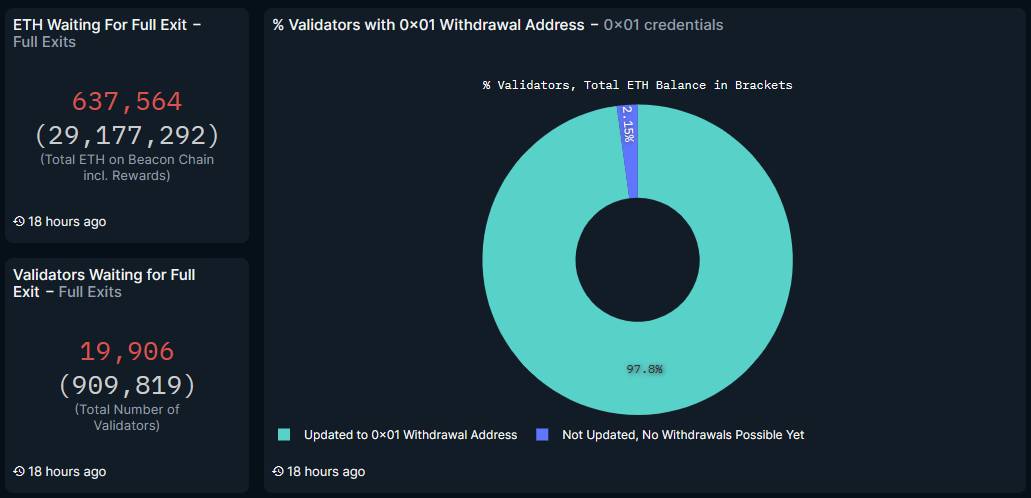

However, according to Nansen, there are actually 637,564 ETH (out of a total of 29,177,292 ETH including rewards) with 19,906 validators (out of a total of 909,819 validators) currently confirming withdrawal queues. This records an approximate near-peak volume since the completion of the Shanghai upgrade in April 2023.

The rush to withdraw ETH ensued immediately after lending company Celsius declared bankruptcy and announced plans to halt Ethereum staking. This move aimed to ensure liquidity for the asset redistribution among creditors and cover operational costs during the business restructuring. Unintentionally, this stirred the crypto community, continuously sharing staking wallets holding over $453 million worth of the company’s ETH.”

“Furthermore, an analyst at 21Shares suggests that the disclosed figures do not encompass all of Celsius’ ETH holdings. There is an additional $775 million worth of ETH attributed by Nansen to Figment—a firm specializing in staking for large entities—likely associated with the bankrupt lending company.

The 21Shares analyst cited past evidence when Celsius purchased 428,000 stETH (equivalent to $781 million) from Lido in late May 2023. Just over two weeks later, they reallocated these assets into new staking contracts, including 197,000 ETH to Figment’s staking address.

The news partially affected the Ethereum community’s sentiment negatively, as concerns arose regarding their investment portfolios. The price of ETH also immediately experienced a slight adjustment, dropping approximately 2% from the initial trading mark of $2,250 to $2,210.

READ MORE NEWS ON

Bitcoin | Inflation Deflation Deflation Inflation Cryptocurrencies

* We hope this information will help you in your investment process, but this is not investment advice. Every investment carries risk, especially in this industry, so DYOR before making a decision.

ABOUT THE AUTHOR