Franklin Templeton Revolutionizes Fund Transfers With Peer-To-Peer Capability In US Government Money Fund On Blockchain Platform

Franklin Templeton has announced that it will allow investors to trade the BENJI token, which represents shares in the Franklin OnChain U.S. Government Money Fund, directly with each other on Polygon and Stellar.

Franklin Templeton, with over $1.5 trillion in assets under management, has announced that investors in its Franklin OnChain U.S. Government Money Fund (FOBXX) can now transfer shares directly with each other through the fund’s tokenized representation, the BENJI token, issued on the Stellar and Polygon blockchains.

BENJI is a token that represents shares in the fund, which includes investments in U.S. government securities, cash, and repurchase agreements. Additionally, BENJI also offers returns to token holders.

Franklin Templeton was the first U.S.-registered fund to use blockchain to settle trades and represent ownership of shares in 2021.

We are excited that BENJI token holders will have the ability to transfer shares amongst each other.Eventually, we hope for assets built on blockchain rails, such as the Franklin OnChain U.S. Government Money Fund, to work seamlessly with the rest of the digital asset ecosystem.

Roger Bayston, Head of Digital Assets at Franklin Templeton, said:

Franklin Templeton’s move clearly shows competition with the BUILD Fund, a tokenized fund in collaboration with BlackRock and Securitize on Ethereum.

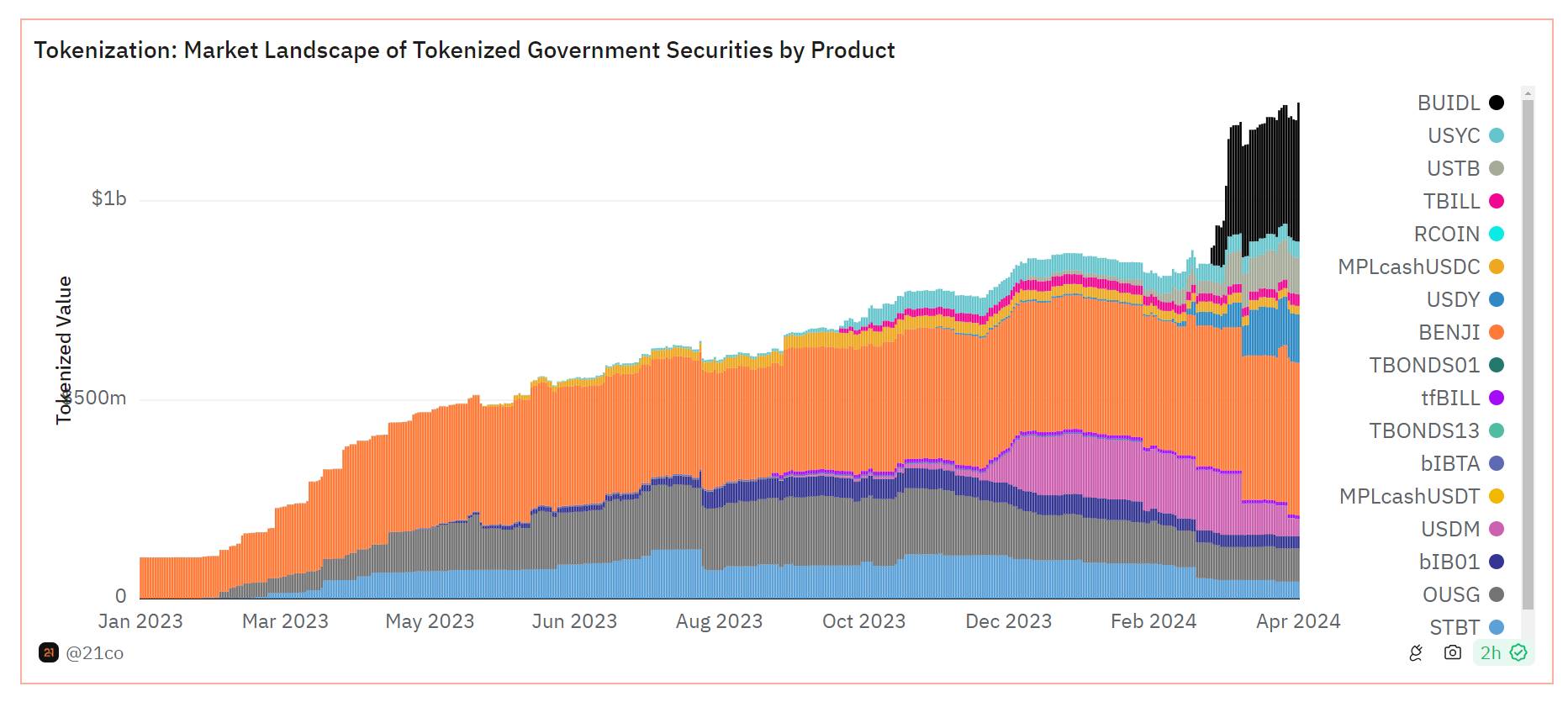

The BUILD Fund has grown rapidly to capture 25% of the market just one month after its launch and has attracted a lot of attention from the community recently.

Franklin Templeton currently leads the government securities tokenization segment, accounting for over 32% of the market share representing a USD 384 million asset block. The total assets under management by these tokenized funds are now around USD 1.2 billion, a tenfold increase since the beginning of 2023.

BlackRock and Franklin Templeton are also two organizations that have issued Bitcoin spot ETFs and are in the process of lobbying for Ethereum spot ETFs.

READ MORE NEWS ON

Bitcoin | Inflation Deflation Deflation Inflation Cryptocurrencies

* We hope this information will help you in your investment process, but this is not investment advice. Every investment carries risk, especially in this industry, so DYOR before making a decision.