Victory Securities Unveils Bitcoin & Ether ETF Fee Structure In Hong Kong

Although the Hong Kong Securities and Futures Commission (SFC) has yet to publish an approved list of ETF issuers, Victory Securities has revealed its proposed fees for Bitcoin and Ethereum ETFs.

Victory Securities, an investment firm based in Hong Kong, has disclosed its proposed fee structure for its Bitcoin (BTC) and Ethereum (ETH) exchange-traded funds (ETFs). This announcement follows the recent approval of cryptocurrency ETF products in the region.

This disclosure is notable because the Hong Kong Securities and Futures Commission (SFC) has not yet released the list of authorized ETF issuers.

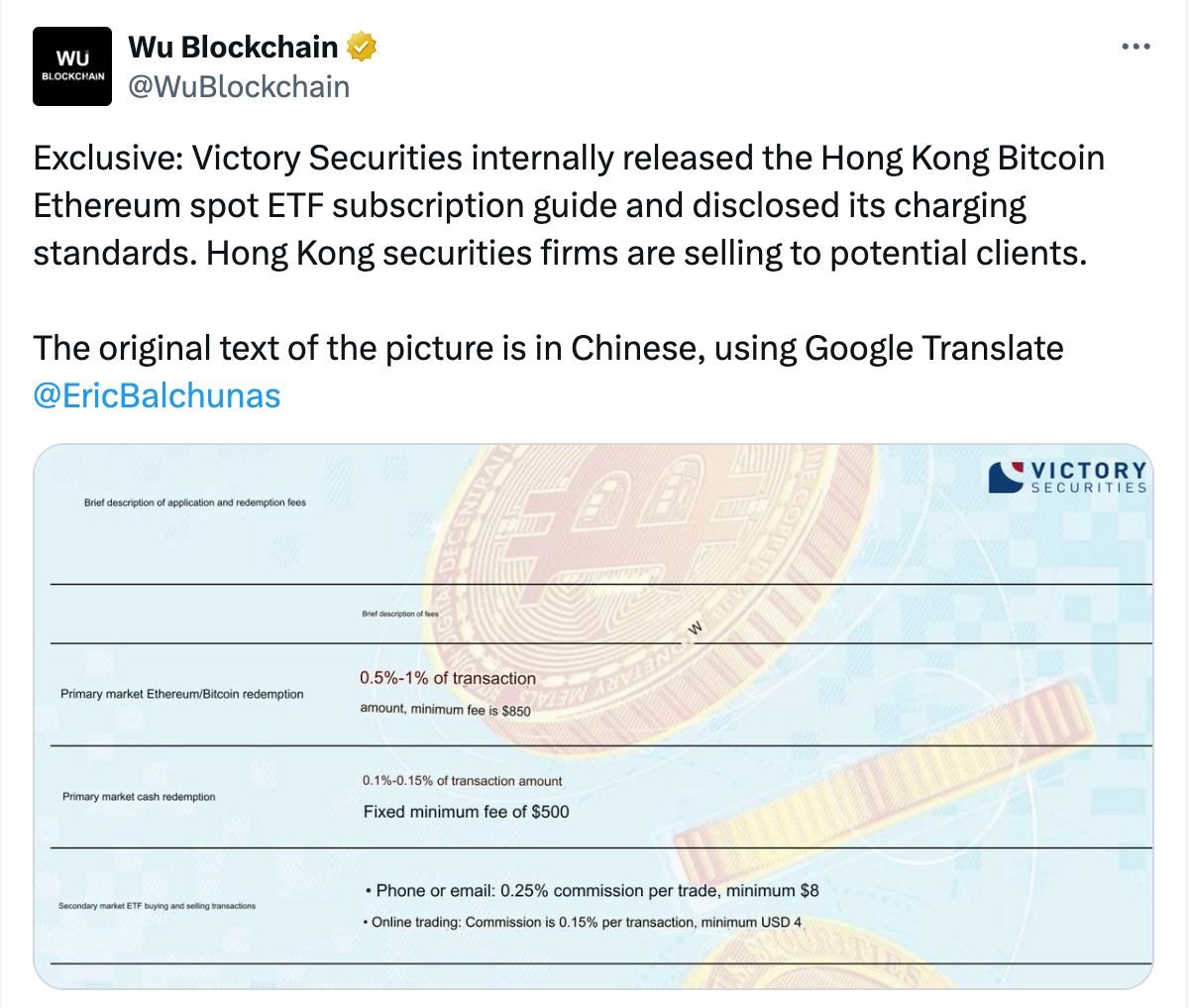

If approved by the SFC, Victory Securities’ fees for Ethereum and Bitcoin ETF shares in the primary market will range from 0.5% to 1% of the transaction total, with a minimum fee of $850, according to a translated report shared by Wu Blockchain on April 20.

For investors looking to trade ETF shares on the secondary market, the fees will be 0.15% for online transactions and 0.25% for transactions conducted over the phone.

The fees are comparable to those set by U.S. asset managers offering spot Bitcoin ETFs. While various fee waivers are in place in the U.S. until later this year, Franklin Templeton charges a fee of 0.19%, with other ETFs varying between 0.20% and 0.90%.

In contrast, the Grayscale Bitcoin Trust (GBTC) charges a significantly higher fee of 1.5%.

On April 15, Cointelegraph reported that Hong Kong is the latest jurisdiction to approve spot ETFs for Bitcoin and Ether.

At least three offshore Chinese asset managers, including the Hong Kong divisions of Harvest Fund Management, Bosera Asset Management, and China Asset Management (ChinaAMC), plan to launch their spot Bitcoin and Ether ETFs shortly.

Although the approval was welcomed by many in the crypto community, including local Hong Kong exchanges, some expressed skepticism about the potential success of the ETF in the region.

“Mainland China investors probably won’t be eligible to buy Hong Kong-listed spot bitcoin and ether ETFs as they are barred from buying virtual assets,” Bloomberg ETF analyst Eric Balchunas stated in an April 17 post on X.

READ MORE NEWS ON

Bitcoin | Inflation Deflation Deflation Inflation Cryptocurrencies

* We hope this information will help you in your investment process, but this is not investment advice. Every investment carries risk, especially in this industry, so DYOR before making a decision.