Magic Eden Outshines Blur As Top NFT Marketplace In Record-Breaking March, Says Coingecko

The main drivers, according to CoinGecko, are Magic Eden’s introduction of the Diamond reward program and its ongoing commitment to uphold creator royalties.

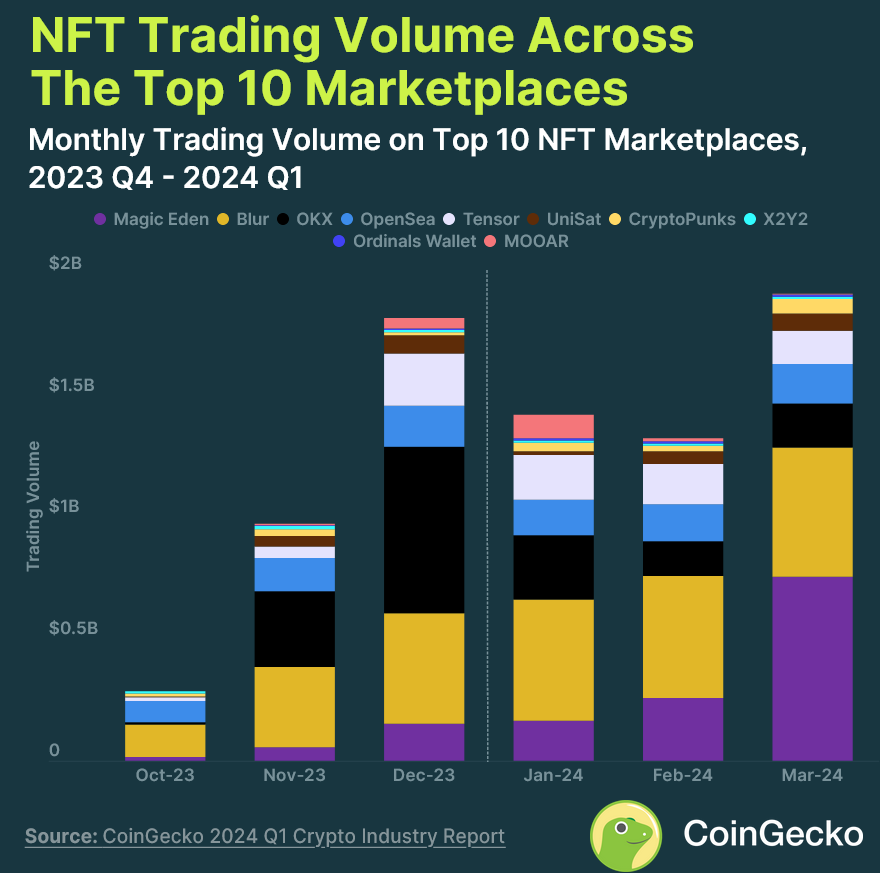

March saw Magic Eden, a Solana-based NFT marketplace, achieve its highest monthly trading volume to date, outstripping the leading industry player, Blur.

CoinGecko’s Q1 2024 report, released on April 17, reveals that Magic Eden experienced a staggering 194.4% surge in NFT trading volume to $756.5 million, while Blur saw a modest increase to $530.4 million during the same period.

CoinGecko attributes part of Magic Eden’s ascent in rankings to its innovative Diamond reward program and its steadfast collaboration with Yuga Labs. This ascent coincided with Yuga Labs severing ties with NFT marketplaces lacking support for creator royalties.

Magic Eden’s trading volume has now risen for six consecutive months, underscoring its sustained growth trajectory.

March marked a significant shift as Blur lost its position as the leading NFT marketplace by trading volume for the first time since the Bitcoin Ordinals craze capitalized by OKX’s NFT marketplace in December. Prior to this, Blur had maintained its lead for 10 consecutive months, surpassing OpenSea in February 2023.

However, OKX has witnessed a substantial decline in Bitcoin NFT trading volume since then, losing ground to platforms like Magic Eden and UniSat. Consequently, its trading volume has plummeted by 73.3% since December to $180 million.

Despite this setback, OKX still secured the third-highest NFT trading volume in Q1 2024, with Solana-based Tensor and OpenSea completing the top five rankings.

In Q1 2024, the combined NFT trading volumes of the top 10 marketplaces reached $4.7 billion, marking a notable 51.6% increase from Q4 2023.

Despite the overall rise in trading volumes, the floor prices of leading NFT collectibles like Bored Ape Yacht Clubs and CryptoPunks have experienced significant declines of over 91% and 64%, respectively, since their peak values in May 2022 and October 2021.

Recently, the enforcement of creator royalties has emerged as a significant issue between NFT marketplaces and studios.

OpenSea, once the predominant NFT marketplace, sparked controversy when it discontinued its on-chain royalty enforcement tool in August. CEO Devin Finzer cited the tool’s lack of anticipated success and alleged circumvention by competitors like Blur, Dew, and LooksRare, who reportedly integrated the Seaport Protocol to evade OpenSea’s blacklist and thus sidestep creator fees.

However, earlier this month, OpenSea partially reversed its stance by introducing support for an ERC-721C programmable earnings standard.

READ MORE NEWS ON

Bitcoin | Inflation Deflation Deflation Inflation Cryptocurrencies

* We hope this information will help you in your investment process, but this is not investment advice. Every investment carries risk, especially in this industry, so DYOR before making a decision.