Hot Updates: AVAX Rockets Back To The Power Top 10, ETH Hits All-Time Low In Supply!

Decrypt Merges With Web3 Platform Rug Radio

According to an announcement on December 10, Decrypt and Rug Radio will merge operations next year. While they have not yet agreed on a new representative name, both have said that they will currently maintain their brands, identities, and teams.

Rug Radio is a Web3 content platform that provides video and podcast content for creators. Rug Radio takes a 25% cut of the revenue generated from agreements between creators and advertisers. The company expects to generate $3 million in revenue in 2023.

In the meantime, Decrypt has been a well-known news site in the cryptocurrency community for a long time. Decrypt earns money primarily from selling advertising for its Web3 content, and the site also has about $3 million in annual revenue, according to CEO and journalist Josh Quittner.

The merger of operations will help both parties take advantage of each other’s strengths. Decrypt can reach Rug Radio’s creator community and expand its revenue stream, while Rug Radio will receive fees from advertising contracts.

It is known that Rug Radio currently has 12 full-time employees, while Decrypt has 22 employees. All of them will stay with the company during the merger.

Rug Radio presently employs 12 full-time staff, and Decrypt has a team of 22 employees. All will remain with the company after the merger.

GFO-X, A Cryptocurrency Derivatives Exchange, Has Raised $30 Million In Series B Funding.

GFO-X, a cryptocurrency derivatives exchange licensed in the United Kingdom, has just completed a $30 million Series B funding round led by M&G Investments. M&G Investments is a $332 billion asset management arm owned by a giant pension fund.

The new capital will help GFO-X accelerate the launch of its upcoming project. Founded in 2020, the platform targets institutional clients looking for a safe place to trade derivatives.

In April 2023, GFO-X partnered with the clearing house of the London Stock Exchange (LSEG) in France. In addition, LSEG has also expressed its intention to establish a traditional asset exchange based on blockchain infrastructure.

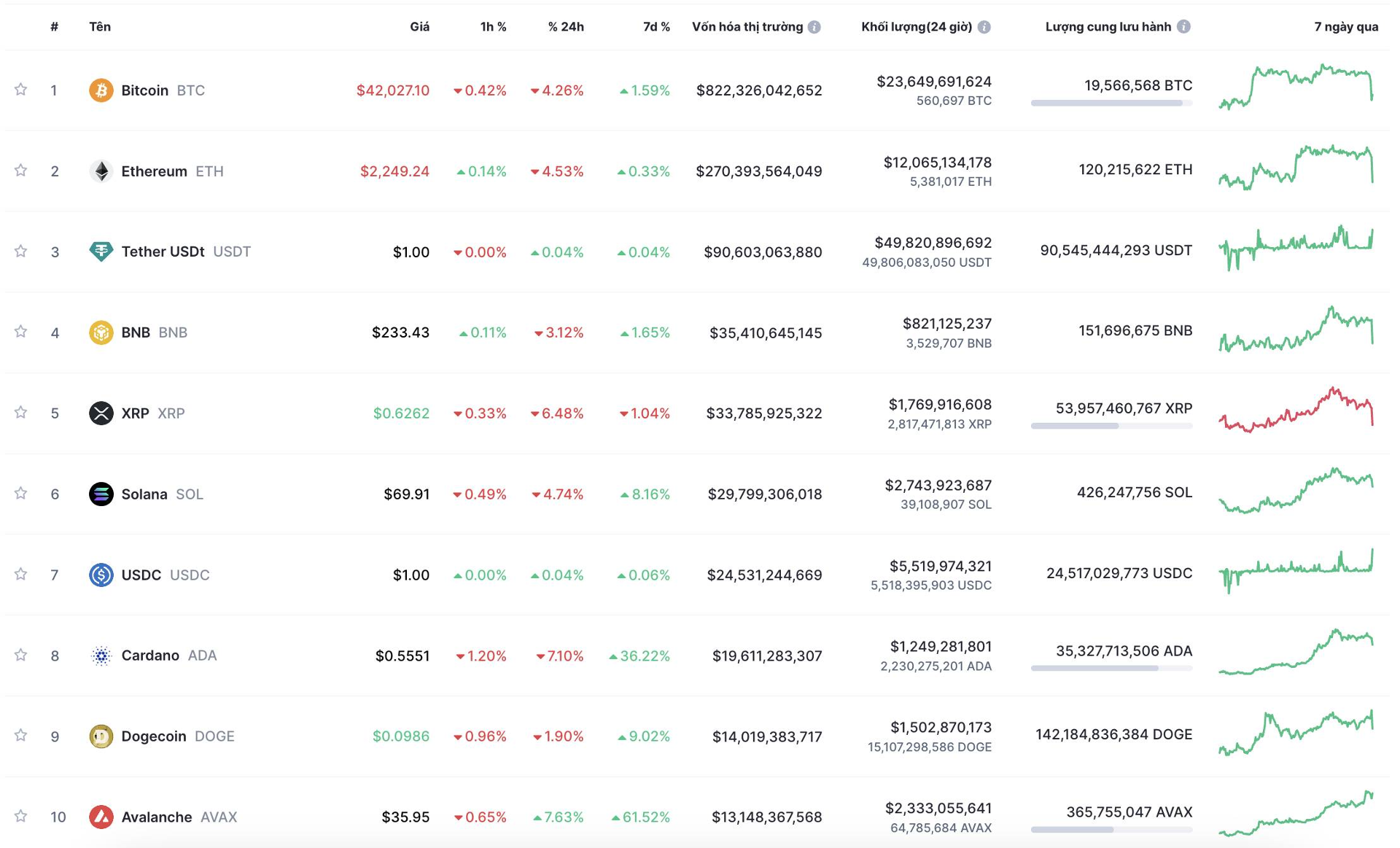

AVAX Is Back In The Top 10 Largest Cryptocurrencies

The cryptocurrency market witnessed a strong resurgence of altcoins over the weekend. In addition to layer-1s like Ethereum and Solana hitting 19-month highs, Avalanche also saw impressive growth, rising over 60% in the past week.

The latest rally helped AVAX break into the top 10 largest cryptocurrencies by market capitalization. At the time of writing, AVAX has a market capitalization of $12.9 billion, trailing the ninth-largest cryptocurrency, Dogecoin (DOGE), with $13.9 billion, according to CoinMarketCap.

The momentum for Avalanche’s recent growth has come from partnerships with major financial institutions such as JP Morgan and Citi. However, Ava Labs, the development team behind Avalanche, is showing some signs of trouble, having cut 12% of its staff and shutting down its blockchain explorer SnowTrace due to lack of funding to maintain it.

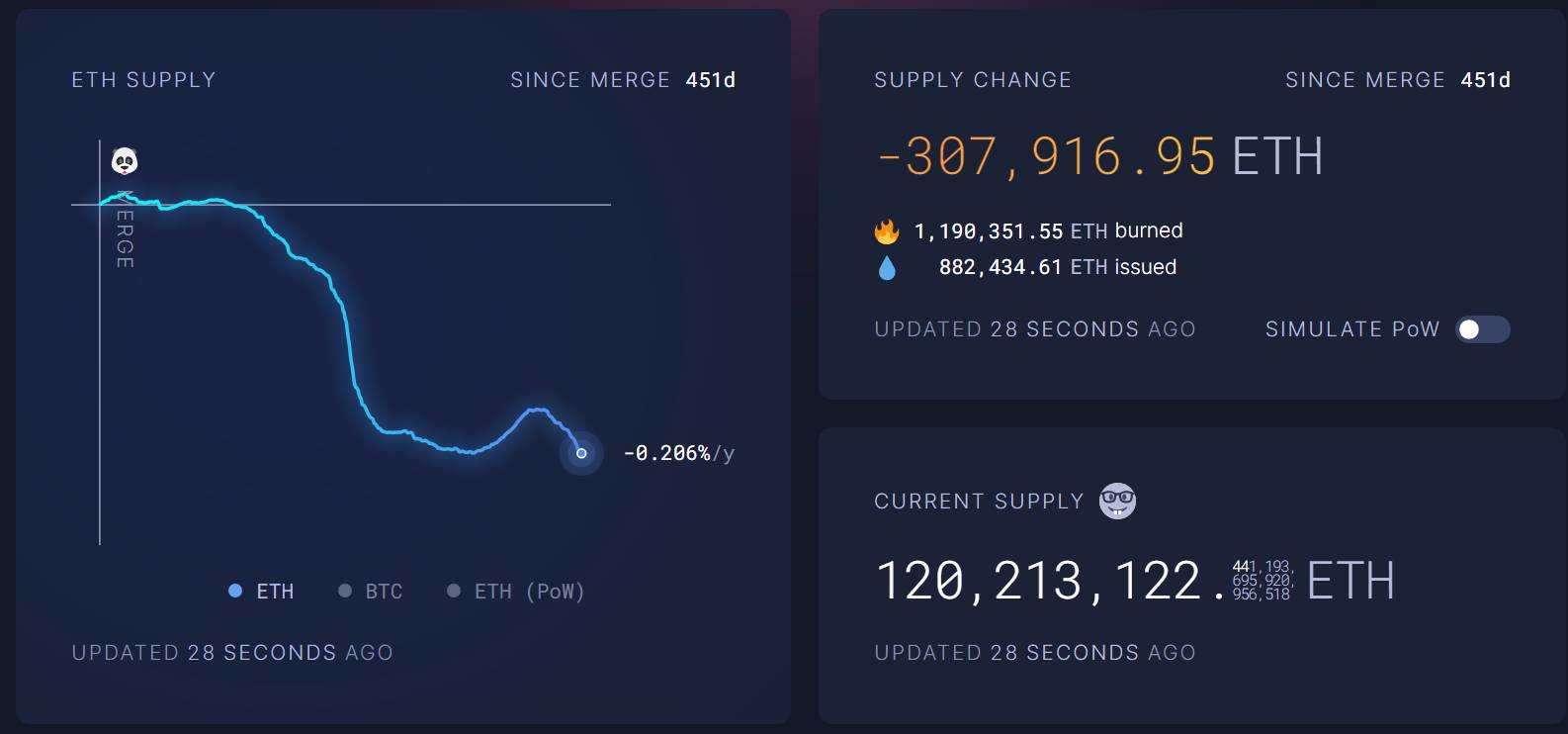

ETH Supply Continues To Decline To New Lows Since The Merge

According to data from Ultrasound.money, the supply of Ethereum (ETH) as of the morning of December 11, 2023, has decreased by over 307,917 ETH since The Merge in September 2022. This milestone marks the beginning of the journey to bring the second-largest cryptocurrency network in the world to an annual deflation rate of 0.058%.

Over the past month, Ethereum’s supply has reduced by over 46,360 ETH. This marks the highest adjustment since Ethereum transitioned to the Proof-of-Stake (PoS) consensus mechanism post The Merge, replacing the previously unfriendly Proof-of-Work (PoW) mining with a transaction validation model through coin staking on the network.

PoS is known to not only slash energy consumption by 99% but also transition annual ETH issuance from +3.488% to -0.058%.

While in its primitive PoW blockchain state, the ETH inflation rate used to hover around 3.15% annually. The network achieved its first deflationary state on 11/09, driven by a surge in transaction demand following the catastrophic FTX crash.

READ MORE NEWS ON

Bitcoin | Inflation Deflation Deflation Inflation Cryptocurrencies

* We hope this information will help you in your investment process, but this is not investment advice. Every investment carries risk, especially in this industry, so DYOR before making a decision.