Bitcoin ETF Registrations Skyrocket At SEC As Approval Deadline Looms

Five spot bitcoin ETF applicants have submitted their funds as securities to the SEC as the approval deadline nears. However, experts clarify that additional steps are necessary before potential SEC approval for these ETFs.

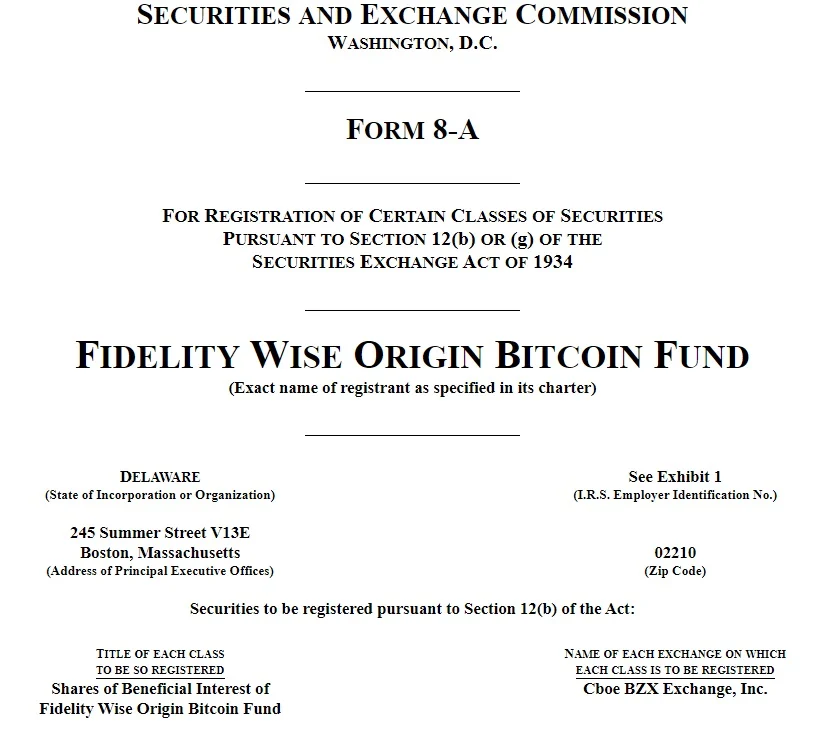

Vaneck, Valkyrie, Fidelity, Bitwise & Grayscale Apply to Register Spot Bitcoin ETFs as Securities With SEC

Multiple asset managers have submitted their spot bitcoin exchange-traded funds (ETFs) for SEC registration. The initial deadline for a decision on these ETFs is Jan. 10, but there’s anticipation for an earlier ruling.

Thursday saw submissions from Vaneck, Valkyrie, and Grayscale Investments. Fidelity filed on Wednesday, while Bitwise’s filing took place last week. Grayscale and Bitwise target listing on NYSE Arca, while Vaneck and Fidelity aim for the Cboe BZX Exchange. Valkyrie’s focus is on listing with Nasdaq.

Fidelity’s filing details: “The securities to be registered hereunder are shares … of the Fidelity Wise Origin Bitcoin Fund … An application for listing of the shares of the trust has been filed with and approved by Cboe BZX Exchange, Inc.”

Additional Procedures Needed Before Introduction Of Spot Bitcoin ETFs

Some on social media mistook SEC filings for the approval of spot Bitcoin ETFs.

Bloomberg’s James Seyffart clarified that for an ETF to launch, completion of Form S-1 (registration) and approval of Form 19b-4 for a rule change by an SRO are essential. He emphasized the absence of the 19b-4 approval and the preliminary status of the S-1 document.

While noting that securities registration needs to be done before a spot bitcoin ETF can launch, the analyst emphasized: “But they don’t mean they’re approved or anything — yet.”

Vaneck’s Director of Digital Assets Strategy, Gabor Gurbacs, detailed the process for launching a spot Bitcoin ETF or any Exchange-Traded Products (ETPs) on X Wednesday:

An issuer can register a security, but approved 19b-4 and effective S-1 still needed to be in place to launch an ETF/ETP … it’s clear that people know very little about the ETF process and hype up everything. Stay calm and enjoy the show.

READ MORE NEWS ON

Bitcoin | Inflation Deflation Deflation Inflation Cryptocurrencies

* We hope this information will help you in your investment process, but this is not investment advice. Every investment carries risk, especially in this industry, so DYOR before making a decision.