Swiss Bitcoiners On A Mission To Enlighten Central Bank With “Orange Pill” Efforts

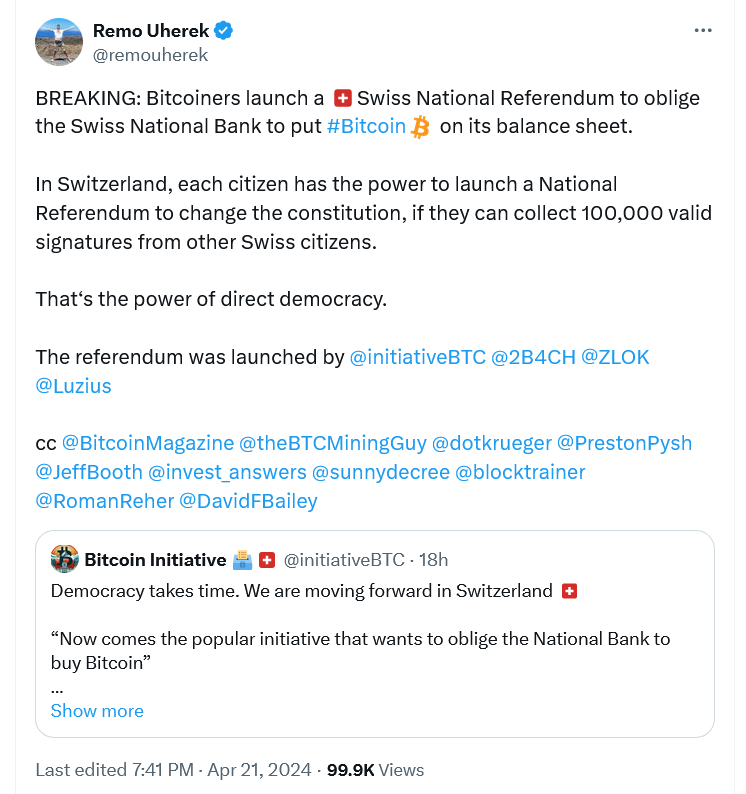

The Bitcoiners must persuade 100,000 Swiss nationals to sign a petition to initiate a referendum—an obstacle that hindered their initial attempt in October 2021.

A group of Swiss-based Bitcoiners is reviving efforts to compel the Swiss National Bank to include Bitcoin (BTC) in its reserves by holding a referendum to amend the Swiss constitution. However, they must first gather over 100,000 signatures from Swiss citizens to get the process started.

Incorporating Bitcoin into the central bank’s reserves would bolster the country’s “sovereignty and neutrality” in a world of growing uncertainty, according to Yves Bennaïm, founder and chairman of 2B4CH, a nonprofit think tank spearheading the initiative.

“We are in the process of completing the organizational preparations for the committee and preparing the documents that must be submitted to the State Chancellery in order to start the process,” Bennaïm told Swiss news outlet Neue Zürcher Zeitung (NZZ) on April 20.

To hold a referendum on matters proposed by Swiss nationals or groups, 100,000 signatures from Swiss citizens must be collected within 18 months. This requirement posed a significant challenge for 2B4CH during its first attempt in October 2021.

2B4CH launched its “Bitcoin Initiative” around that time, with the goal of amending Article 99-3 of the Swiss Federal Constitution to include Bitcoin as a reserve currency.

Switzerland has a population of 8.77 million, which means that roughly 1.15% of its citizens must sign the petition for the referendum to proceed.

“By including Bitcoin in its reserves, Switzerland would mark its independence from the European Central Bank. Such a step would strengthen our neutrality,” said Luzius Meisser, president of the Bitcoin-focused trading platform Bitcoin Suisse, who is assisting Bennaïm with the initiative.

Meisser plans to persuade the Swiss National Bank to consider the benefits of including Bitcoin on its balance sheet in a meeting scheduled for April 26. He will have just three minutes to present his case.

Previously, the executive proposed that the central bank invest 1 billion Swiss francs ($1.1 billion) in Bitcoin every month as an alternative to German government bonds in March 2022, as reported by NZZ.

However, in April 2022, Swiss National Bank Chair Thomas Jordan reportedly stated that Bitcoin didn’t meet the requirements for the SNB to consider it a reserve currency.

Meisser now asserts that Switzerland would be 30 billion Swiss francs ($32.9 billion) wealthier had the Swiss National Bank followed his advice in 2022. He warns that further delays could lead to other central banks buying up Bitcoin, potentially forcing Switzerland to acquire it at “significantly higher prices than everyone else.”

Leon Curti, head of research at Digital Asset Solutions, remains optimistic that the recent approval of spot Bitcoin exchange-traded funds (ETFs) in the United States and Hong Kong might encourage the Swiss National Bank to invest in Bitcoin.

The NZZ article received a positive reaction from Joana Cotar, a German politician and Bitcoin advocate who is a staunch opponent of a European Union-backed digital currency.

CoinNerd reached out to 2B4CH for comment but did not receive an immediate response.

READ MORE NEWS ON

Bitcoin | Inflation Deflation Deflation Inflation Cryptocurrencies

* We hope this information will help you in your investment process, but this is not investment advice. Every investment carries risk, especially in this industry, so DYOR before making a decision.