VanEck Pledges 5% Of Bitcoin ETF Profits For Support & Development Of Bitcoin Core Developers

Last year, VanEck made a similar commitment regarding the profits from its Ethereum futures ETF.

The major U.S. asset management firm, VanEck, will allocate 5% of profits from its Bitcoin spot ETF product to contribute to Bitcoin Brink developers over a minimum period of 10 years.

Not only committing to long-term partnership, but VanEck also previously allocated $10,000 in individual support for Brink. Shared in an announcement on January 5th, VanEck stated:

We’re not Bitcoin tourists at VanEck. We’re in it for the long haul. Your tireless dedication to decentralization and innovation is the cornerstone of the Bitcoin ecosystem, and we’re here to support it—more details to come.

Established in 2020, Brink aims to research and advance protocols while supporting the Bitcoin developer community. Brink also offers a scholarship program for talented software engineers. In June 2023, Brink received a $5 million grant from Jack Dorsey’s Smart Small funding program.

Last September, VanEck made a similar decision. The asset management fund committed to donating 10% of profits from its Ethereum futures ETF product to the Protocol Guild, a group of 150 developers pivotal in the largest DeFi ecosystem. They’ve been involved in major upgrades like The Merge and Shanghai, as well as ongoing developments.

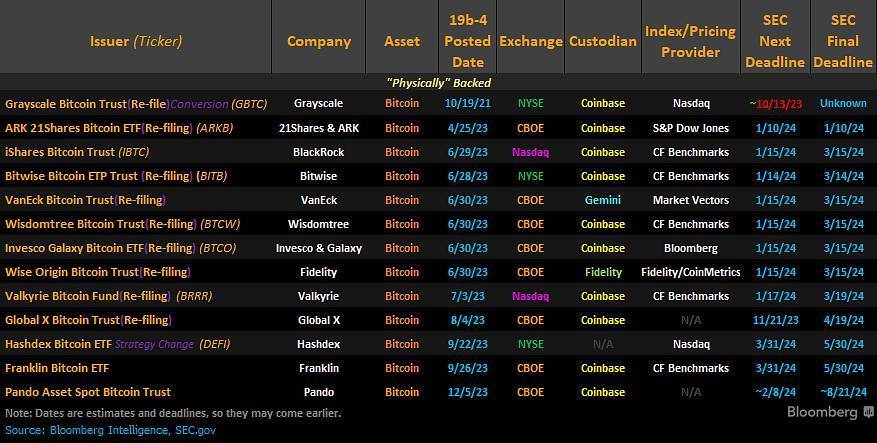

VanEck has filed applications for both Bitcoin and Ethereum ETFs in futures and spot forms, but the SEC has only greenlit the ETF for Ethereum futures while delaying the remaining applications.

Alongside major financial players like BlackRock, Fidelity, Grayscale, Ark Investments, Valkyrie, WisdomTree, and Franklin Templeton, VanEck is anxiously awaiting the Securities and Exchange Commission’s (SEC) decision on the proposed Bitcoin spot ETF. This stands as the foremost concern within the community, especially with the approaching deadline for the SEC’s announcement (coming up on January 10th).

The reason why the news on Bitcoin spot ETF is closely followed by the public is because it’s seen as a channel for new capital inflow from traditional finance into the relatively young crypto field.

However, not everyone welcomes or views it as an exciting development for the cryptocurrency market. For instance, Matrixport, an investment fund, boldly made an unsubstantiated prediction that the SEC would reject all Bitcoin spot ETF applications, leading to a sudden over $4,000 drop in Bitcoin’s price on the evening of January 3rd.

READ MORE NEWS ON

Bitcoin | Inflation Deflation Deflation Inflation Cryptocurrencies

* We hope this information will help you in your investment process, but this is not investment advice. Every investment carries risk, especially in this industry, so DYOR before making a decision.

ABOUT THE AUTHOR